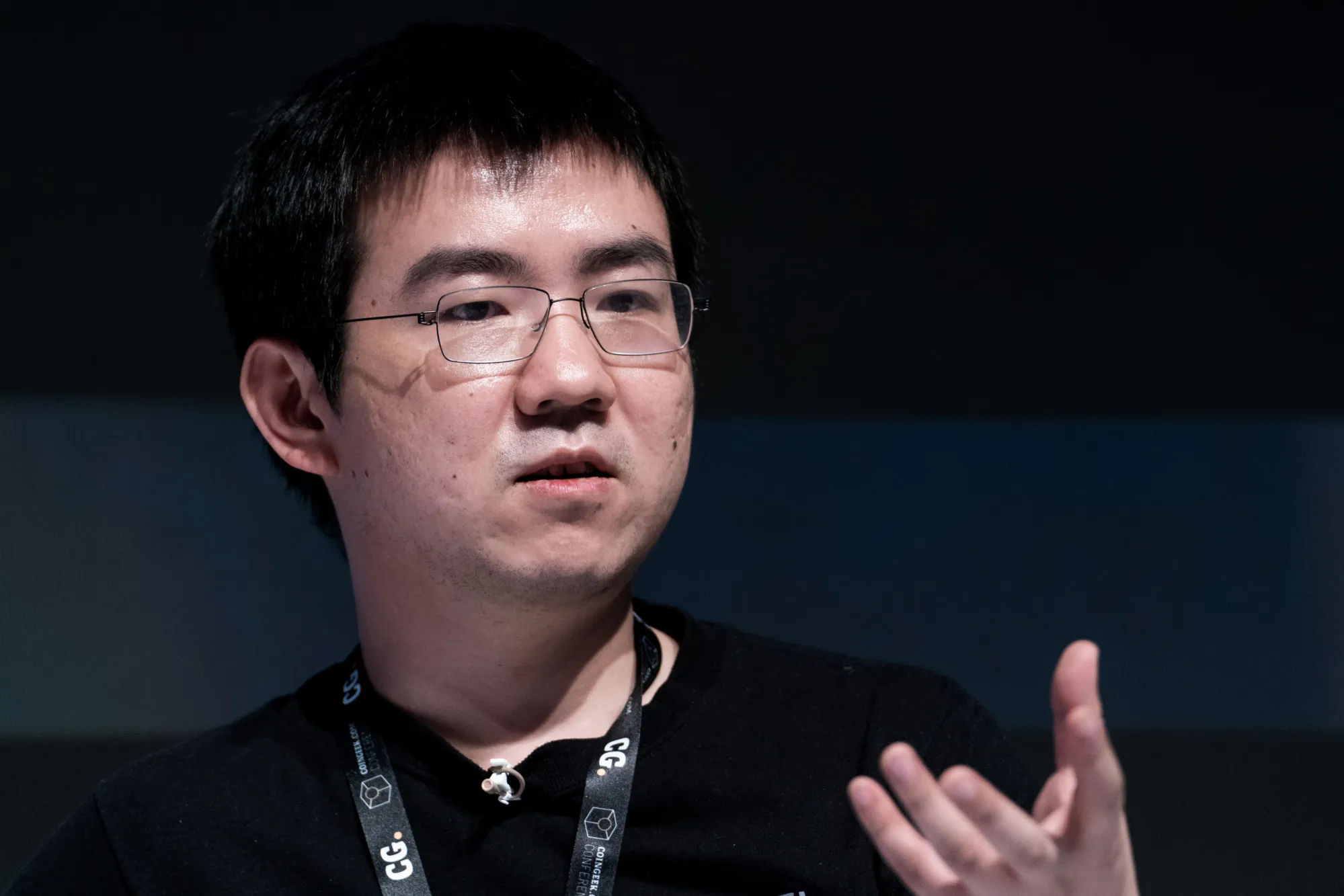

On the final day of the New Economy Forum, one question hovered over the audience: how will artificial intelligence be powered at the scale the world demands? Few can answer that better than Jihan Wu, co-founder of Bitdeer, a company at the cutting edge of Bitcoin mining and AI infrastructure.

Wu’s journey is a masterclass in foresight. From pioneering Bitcoin mining and designing crypto hardware to now building AI-ready data centers, he is operating at the intersection of two of the world’s most resource-intensive technologies. Bitdeer designs its own mining chips and manufactures PICO machines, controlling the full vertical of the mining business. Efficiency, scale, and cost-effectiveness define the company and Wu says proudly, “We believe we are among the best miners in the world.”

YOU CAN ALSO READ: Blending Chemistry With Corporate Leadership: Unilever Welcomes Uchenna Nwakanma to Its Board

The connection between Bitcoin mining and AI might surprise some, but Wu is quick to make it clear. Bitcoin miners have already built the backbone AI data centers need: transmission lines, trained labor, permits, and the massive infrastructure required to move gigawatts of power. “Bitcoin mining has laid the foundation for AI,” Wu explains. “We have done the heavy lifting, and now it can be converted to fuel AI growth.”

Bitdeer currently commands three gigawatts of power demand globally, with two gigawatts in the U.S. Wu plans to convert all of it to AI infrastructure over the next five years while simultaneously developing dual-use assets that can serve both Bitcoin and AI. “Timing is everything,” he says. “All our constructions are designed to be flexible and future-proof.”

Despite the AI frenzy, Wu isn’t abandoning Bitcoin. He has been in mining since 2012 and co-founded the world’s largest Bitcoin mining company. Maintaining mining operations provides cash flow stability and hedges against the unpredictability of AI investments. “Bitcoin has a long-term future,” he says.

The road is not without hurdles. Mining margins fluctuate, halving cycles reduce rewards, and macroeconomic pressures influence liquidity. Yet return on assets remains strong, and the strategic dual focus positions Bitdeer to thrive no matter which way the technology winds blow.

AI is demanding unprecedented capital. Unlike familiar low-CapEx, high-profit tech models, AI requires billions upfront for data centers and GPUs. Wu’s perspective, honed from years of infrastructure development, sees opportunity in constraint. Rising GPU demand, limited supply due to regional regulations, and geopolitical realities make the market both challenging and ripe for investment.

Bitdeer is not just building capacity; it is innovating. Wu’s team is developing chips that could cut power usage by 70 to 80 percent, potentially licensing the designs to GPU and TPU manufacturers worldwide. Meanwhile, a new factory in Nevada signals a bold step: bringing manufacturing to the U.S. despite higher costs and tighter labor markets, balancing efficiency with geopolitical realities.

YOU CAN ALSO READ: Blending Chemistry With Corporate Leadership: Unilever Welcomes Uchenna Nwakanma to Its Board

Looking ahead, Wu sees enormous opportunity in developing countries, where infrastructure gaps exist but the appetite for technology is high. “Countries that prepare now will be positioned to leapfrog into the AI era,” he says.

Jihan Wu’s vision is more than infrastructure; it is a blueprint for converging industries, solving global tech challenges, and shaping the future. Bitcoin mining, once dismissed as niche, now powers the AI revolution, and those who understand both worlds are leading the charge.