Nigeria’s capital market is experiencing one of its strongest growth phases in recent history, driven by renewed investor confidence, far-reaching economic reforms, and strategic innovation at the Nigerian Exchange Group (NGX).

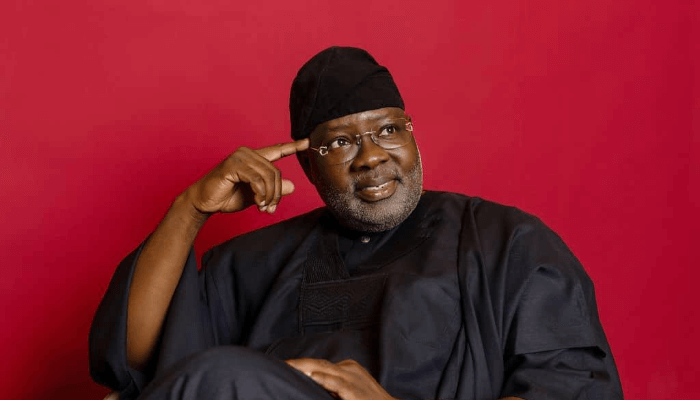

Speaking during an interview on ARISE TV, the Chairman of the Nigerian Exchange Group, Alhaji Umaru Kwairanga, described the performance of the market in 2025 as “nothing short of transformative,” while expressing strong optimism about continued growth in 2026.

“In 2025 alone, we have almost doubled our market capitalisation,” Kwairanga said. “From less than ₦50 trillion at this time last year, the market has grown to over ₦95 trillion today. Our target is to cross ₦100 trillion before the end of the year, and the momentum will continue.”

YOU CAN ALSO READ: Segun Adeyemo Burning Desire in Technology and How he is Scaling Successfully

According to him, a combination of macroeconomic reforms, improved foreign exchange stability, banking sector recapitalisation, and stronger corporate performance has been central to the market’s resurgence. He noted that the All-Share Index has risen by over 45 per cent, while activity in the primary market has increased significantly, supported by new listings across key sectors of the economy.

“The reforms of the current administration have gone a long way in restoring confidence in the Nigerian capital market,” Kwairanga explained. “Bank recapitalisation, better corporate governance, stronger dividend performance, and increased listings have all contributed to the gains recorded in 2025.”

He also highlighted the role of technology in driving market participation. The NGX, he said, undertook a comprehensive review of its processes to simplify access and attract a broader investor base, leading to the launch of digital investment platforms that allow Nigerians to invest remotely.

“We introduced technology to make investing easier and more accessible,” he said. “This played a major role in the success of the banking recapitalisation exercise, which raised over ₦3 trillion this year alone.”

The impact of these initiatives is evident in retail investor participation. Kwairanga revealed that Nigeria had fewer than one million retail investors in 2023, but that figure has grown to over six million.

“That level of growth reflects deliberate restructuring, new leadership, simplified processes, and our embrace of technology,” he added.

Looking ahead, Kwairanga said projections that Nigeria’s market capitalisation could reach ₦262 trillion may even be conservative, given the pace of growth already recorded.

“We are already among the best-performing markets globally, and 2026 will be even better,” he said.

A major driver of future expansion, according to the NGX Chairman, is the anticipated listing of Dangote Group companies. He confirmed that discussions are well advanced for the listing of Dangote Fertiliser, which could significantly increase market size.

“Dangote is a game changer,” Kwairanga said. “The fertiliser listing alone could take the market from ₦100 trillion to close to ₦150 trillion. When the refinery is eventually listed, it has the potential to push market capitalisation beyond ₦200 trillion.”

In addition, the NGX is working with the federal government to prepare state-owned enterprises for listing. Kwairanga disclosed that about 50 companies under the Ministry of Finance Incorporated and the Bureau of Public Enterprises have been identified, with efforts focused on strengthening governance and meeting listing requirements.

He acknowledged existing challenges, including concerns around capital gains tax and Nigeria’s relative position compared to other African markets. However, he said the Exchange is actively engaging policymakers to ensure reforms do not undermine market growth.

“We are in discussions with the government and the tax reform implementation committee,” he said. “We want to ensure that the gains recorded in the capital market, which is one of the strongest success stories of this administration, are sustained.”

YOU CAN ALSO READ: Nigeria Set to Cut Corporate Tax from 30% to 25% by 2026, Opening Doors for FDI, Domestic Growth

To enhance competitiveness and liquidity, Kwairanga noted that NGX recently shortened its settlement cycle from T+3 to T+2, aligning Nigeria more closely with global best practices.

Addressing concerns about whether the current rally is a bubble, the NGX Chairman was emphatic that the growth is sustainable.

“These gains are sustainable,” he said. “We have invested in technology, governance, and market structure. Improved FX liquidity, policy reforms, and the leadership in place today provide a strong foundation for long-term growth.”

He emphasised the need to protect local investors, describing them as the backbone of the Nigerian capital market, as NGX continues its push to position Nigeria as a leading investment destination in Africa.