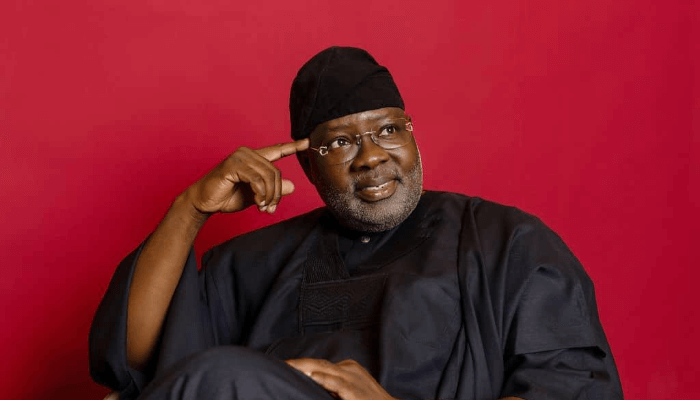

As Nigeria prepares to implement new tax reforms starting January next year, Chairman of the Presidential Fiscal Policy Committee, Taiwo Oyedele has outlined how the measures are designed to promote fairness, stimulate economic growth, and modernize the nation’s tax system.

Addressing stakeholders, Oyedele emphasized that the reforms aim to protect low-income earners. “If you earn ₦100,000 or less per month, you will be exempted from paying personal income tax. That’s one-third of our workforce across both private and public sectors,” he explained. Oyedele noted that taxing those struggling to meet basic needs only worsens social pressures and undermines rational decision-making in society.

You Can Also Read: Segun Adeyemo Burning Desire in Technology and How he is Scaling Successfully

The reforms also target the middle class, defined as individuals earning between ₦100,000 and ₦2 million monthly. “These earners will see a reduction in their tax burden, effectively increasing their take-home pay without any salary increase,” Oyedele said. High-income earners, earning above ₦2 million monthly, will experience marginal tax increases, ensuring a fairer distribution of fiscal responsibility.

Oyedele highlighted the critical link between economic growth and revenue generation, noting that taxes can only be collected if people are employed or running businesses. “The fastest and most sustainable way to generate revenue is to allow the economy to grow,” he said. Corporate income tax will drop from 30% to 25%, returning an estimated ₦1.4 trillion to businesses next year.

The reforms also modernize tax administration, making compliance simpler and more transparent. Oyedele explained that digital systems will soon prepopulate tax returns, reducing bureaucratic hurdles, while tracking spending against declared income ensures accurate self-assessment.

On global process outsourcing, Oyedele revealed that outdated tax policies were limiting Nigeria’s participation. “We’ve removed barriers that discouraged foreign companies from hiring Nigerians. This opens opportunities for young talent, generating jobs and foreign exchange.”

Capital markets also benefit. Oyedele said capital gains tax has been harmonized with income tax, and exemptions for most investors have been introduced, encouraging long-term market participation while preventing speculative exits that destabilize the economy.

You Can Also Read: Nigeria Set to Cut Corporate Tax from 30% to 25% by 2026, Opening Doors for FDI, Domestic Growth

“These reforms are about more than taxes,” Oyedele concluded. “They are about letting businesses grow, creating jobs, supporting Nigerians across income levels, and building a more equitable and sustainable economy.”

The comprehensive measures signal a significant shift in Nigeria’s fiscal policy, aiming to simplify taxation, encourage investment, and strengthen the country’s economic foundation.