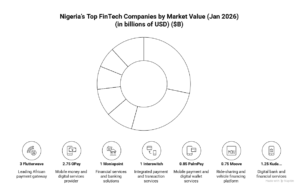

Nigeria’s fintech industry is increasingly defined by scale, structure, and strategic positioning, with recent valuations revealing a market that is no longer flat but clearly tiered. As digital payments, mobile banking, and financial infrastructure deepen across the country, a handful of dominant players have pulled ahead, while a growing field of challengers continues to shape new opportunities within specialised segments.

At the lower end of the valuation spectrum is Paga, estimated at $0.25 billion. Though modest by today’s standards, Paga’s influence extends beyond numbers. The company was instrumental in Nigeria’s early mobile money adoption, helping to introduce millions of users to digital financial services at a time when cash still ruled everyday transactions.

Just above this tier are Kuda and Paystack, each valued at roughly $0.5 billion. Their valuations reflect steady growth and sustained relevance. Kuda’s digital-first banking model has attracted a loyal retail user base, while Paystack’s valuation remains closely linked to its landmark acquisition by Stripe, an event that not only reshaped the company’s trajectory but also signaled global confidence in Nigeria’s fintech potential.

YOU CAN ALSO READ: President Bola Ahmed Tinubu Unveils Vision to Power Nigeria’s Future Through Green Growth Path With $2bn Climate Fund

In the emerging mid-tier, Moove and PalmPay illustrate the expanding scope of fintech beyond payments alone. Moove, valued at $0.75 billion, has carved out a niche in vehicle financing and mobility solutions, demonstrating how fintech can intersect with transportation and asset financing. PalmPay, with a valuation of $0.85 billion, has built strong momentum through consumer-focused mobile wallets, aggressive user acquisition, and incentive-driven growth strategies.

Reaching the billion-dollar threshold are Moniepoint and Interswitch, each valued at $1.0 billion. Their strength lies less in consumer branding and more in infrastructure. Both companies underpin vast portions of Nigeria’s payments ecosystem, providing enterprise solutions, payment processing, and fintech-as-a-service platforms that enable banks, merchants, and digital businesses to operate at scale.

Near the summit is OPay, valued at $2.75 billion, whose rapid expansion has been fueled by deep penetration among merchants and everyday users. Its success reflects the growing demand for simple, reliable payment tools across Nigeria’s informal and formal economies alike.

YOU CAN ALSO READ: FCMB Honoured for Championing Youth-Led Social Impact at Enactus Nigeria 25th Anniversary

At the top of the market stands Flutterwave, valued at $3.0 billion. As a leader in cross-border payments, Flutterwave has positioned itself as a critical bridge between African businesses and global markets, supported by strong international partnerships and a widening global footprint.

Collectively, these valuations paint a picture of a fintech ecosystem marked by concentration at the top and innovation across the middle and lower tiers. While a few dominant players command significant market influence, emerging and specialised fintechs continue to expand Nigeria’s digital economy, reinforcing the country’s position as one of Africa’s most dynamic financial technology hubs.