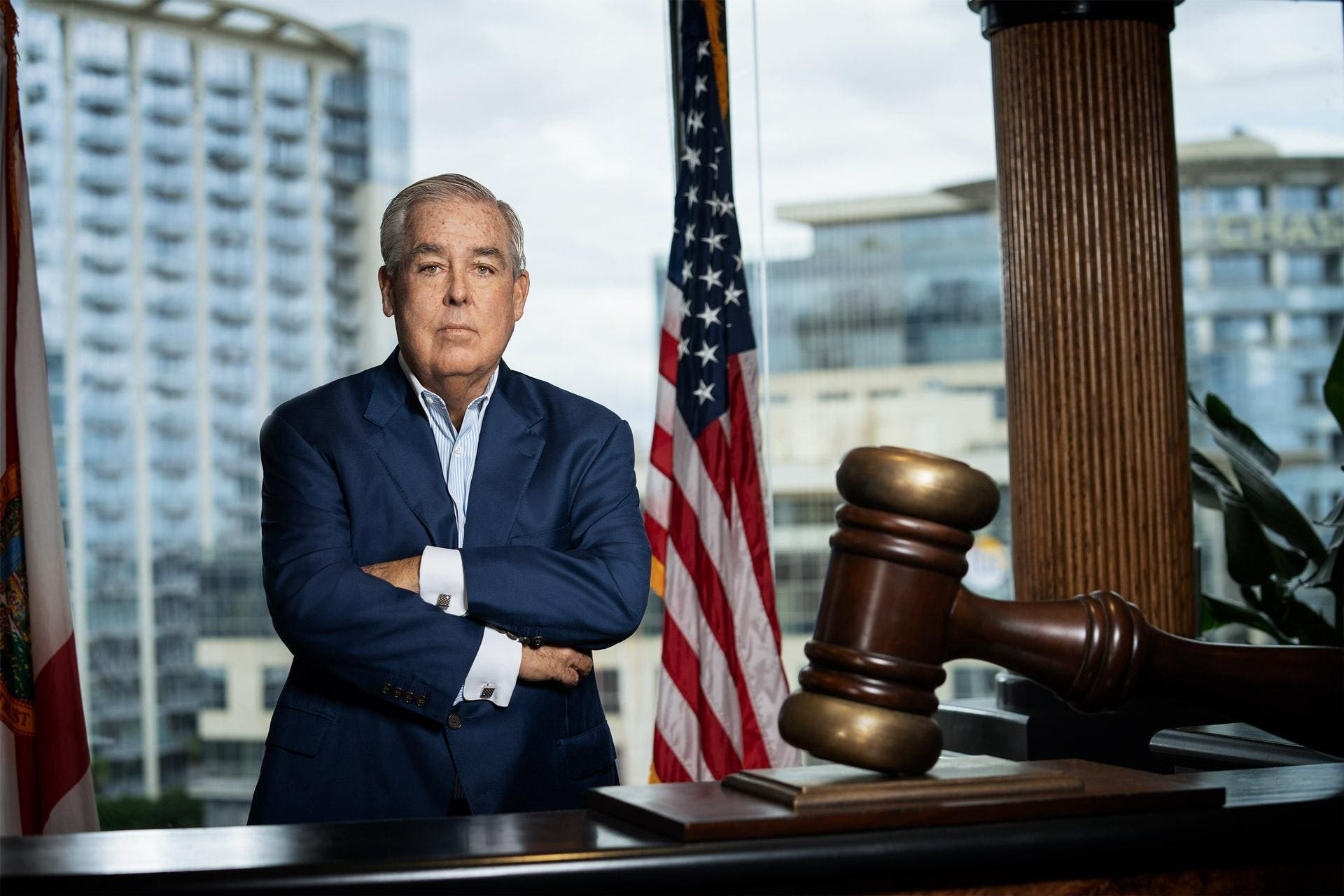

Kenn Ricci did not inherit a fortune. He earned it through relentless determination, calculated risk, and a passion for aviation. Today, he sits atop an empire that includes Flexjet and other private aviation companies, catering to the ultra-wealthy while also shaping the future of private travel. But Ricci’s journey to billionaire status started in far humbler circumstances.

After leaving the Air Force, Ricci briefly worked for Northwest Orient before being furloughed and moving back in with his parents. Rather than seeing this as a setback, he seized the opportunity to start his own business. He launched Professional Flight Crews, a contract pilot service, and soon bought a small company called Corporate Wings for $27,500. Ingeniously, he financed nearly the entire purchase with the company’s own cash and borrowed a small amount from his father to cover the rest.

By the early 1990s, Corporate Wings was generating $3 million in revenue. Ricci expanded the company to service high-profile concert tours, flying stars like Barbra Streisand and Elton John. One of the company’s early political clients, the governor of Arkansas, eventually became President Bill Clinton. Ricci personally flew him to his inauguration, marking a turning point that brought attention and growth to his business.

YOU CAN ALSO READ: From Stability to Growth: Edun Outlines Nigeria’s Economic Direction for 2026

Recognizing opportunities in the rapidly evolving private aviation sector, Ricci launched Flight Options in 1997 to compete with NetJets. Raising capital was initially a challenge, but timing and persistence paid off. In 1998, Warren Buffett’s purchase of NetJets validated the industry, opening doors for Ricci to secure $50 million each from Boeing and Bombardier. Flight Options quickly flourished, generating $100 million in its first three months. Around the same time, he sold Inertial Airline Services, a company he had founded to repair costly airline navigation systems, for $10 million.

In 2002, Flight Options merged with Raytheon, creating a 50/50 partnership. But challenges arose when Ricci offered to buy Raytheon’s half of the business, only for them to buy him out instead. He left the company he founded with $20 million but rather than seeing it as a failure, he turned it into a springboard. Using that capital, he launched Directional Aviation Capital, investing in aviation companies and turning early successes into major windfalls. One notable investment, Mercury Air Centers, sold for $625 million in 2007, producing roughly $400 million in proceeds.

Ricci’s next strategic move came in 2014 when he acquired Flexjet. Bombardier required him to purchase the company along with the jets he wanted to buy. Ricci now calls it transformational. Flexjet brought a prestigious brand, corporate client base, and reputation for excellence into his portfolio. By 2021, after recapitalizing the company to pay down debt, Ricci officially reached a billion-dollar net worth.

Yet for Ricci, wealth is not only about numbers. It is also about values and legacy. He emphasizes transparency and education for his children, holding quarterly family meetings to review net worth, discuss asset allocation, and encourage entrepreneurship. “I am not waiting until I die to pass on wealth,” he says. “I want to watch my kids enjoy it, manage it wisely, and learn how to make money work for them.”

Philanthropy is central to Ricci’s approach to life. He donates millions annually, especially to educational causes, and has made landmark gifts such as a $100 million donation to universities to fund discretionary programs, allowing institutions to spend where it is needed most.

YOU CAN ALSO READ: Inside Nigeria’s Fintech Hierarchy: Who Leads, Who Follows, and Why

Ricci’s lifestyle reflects both discipline and indulgence. His family spends six weeks in Italy every summer, a trip that costs between $750,000 and $800,000. He owns multiple homes and a prized watch collection, which he links to financial milestones and personal achievements. “We are all allowed one vice,” he says.

Ricci also shares practical advice for success and wealth management. From tipping generously upon arrival at restaurants or hotels to teaching his children the nuances of wealth, he combines business acumen with personal generosity.

From buying a $27,500 company with borrowed cash to building a billion-dollar empire, Kenn Ricci’s story is one of vision, grit, and strategic thinking. But it is also a story about family, legacy, and the belief that wealth should be actively managed, enjoyed, and shared. For Ricci, success is not just the bottom line. It is the people, relationships, and memories created along the way.