At the Presidential Villa, Governor Yemi Cardoso of the Central Bank of Nigeria delivered a landmark address to the National Economic Council Conference, offering a compelling narrative of Nigeria’s economic revival. With measured authority and data-driven insight, Cardoso traced the nation’s journey from fiscal turbulence to stability, illustrating how bold reforms are reshaping the financial landscape and laying the groundwork for sustained growth through 2030.

Opening his address, Cardoso reflected on the formidable challenges inherited in 2022. He painted a picture of an economy strained by entrenched fiscal dominance, high inflation at 34.6 percent, and a dysfunctional foreign exchange market burdened with a $7 billion backlog. Investor confidence was shattered, liquidity distortions were pervasive, and the naira struggled to command trust even across the West African subregion. “It was a desperate situation,” he observed, “where confidence had to be rebuilt from the ground up.”

YOU CAN ALSO READ: “We Are Building a Central Bank Nigerians Can Trust,” – Cardoso

The governor then unveiled the three pillars of the CBN’s recovery strategy. The first pillar, a decisive monetary policy reset, included an aggressive 875-basis-point hike in the Monetary Policy Rate, restoring orthodox policy as the foundation for sustainable growth. The second pillar engineered a market-driven foreign exchange regime, emphasizing unification, transparency, and efficient price discovery. The third pillar focused on fiscal coordination and systemic resilience, ensuring states and the federal government adhered to statutory limits on deficit financing and enhanced non-oil revenue generation.

Cardoso highlighted the fruits of these reforms with clarity and pride. Inflation has been tamed to 15.15 percent, GDP growth stands at 3.98 percent, and foreign reserves have surged to $49 billion as of February 2026. The naira has regained credibility, and Nigerian businesses and citizens can now transact with renewed confidence. The banking sector, strengthened through recapitalization and disciplined oversight, is positioned to support the nation’s vision of a one trillion-dollar economy.

Looking to the future, Cardoso presented a bold roadmap for 2026–2030, centered on macroeconomic stability as the engine of productivity. Key initiatives include anchoring disinflation, deepening domestic financial markets, expanding financial inclusion, safeguarding the naira, and enhancing Nigeria’s global competitiveness. He also underscored the critical role of subnational governments in sustaining these gains, emphasizing fiscal discipline, infrastructure investment, and strategic partnerships with the financial system.

By 2030, Cardoso envisions a Nigeria with single-digit inflation, robust foreign reserves fueled by non-oil exports and remittances, a globally competitive financial system, a stable, market-reflective exchange rate, deeper local currency financing, and a financially inclusive economy. He particularly acknowledged the contributions of the Nigerian diaspora in driving capital flows and investment back home.

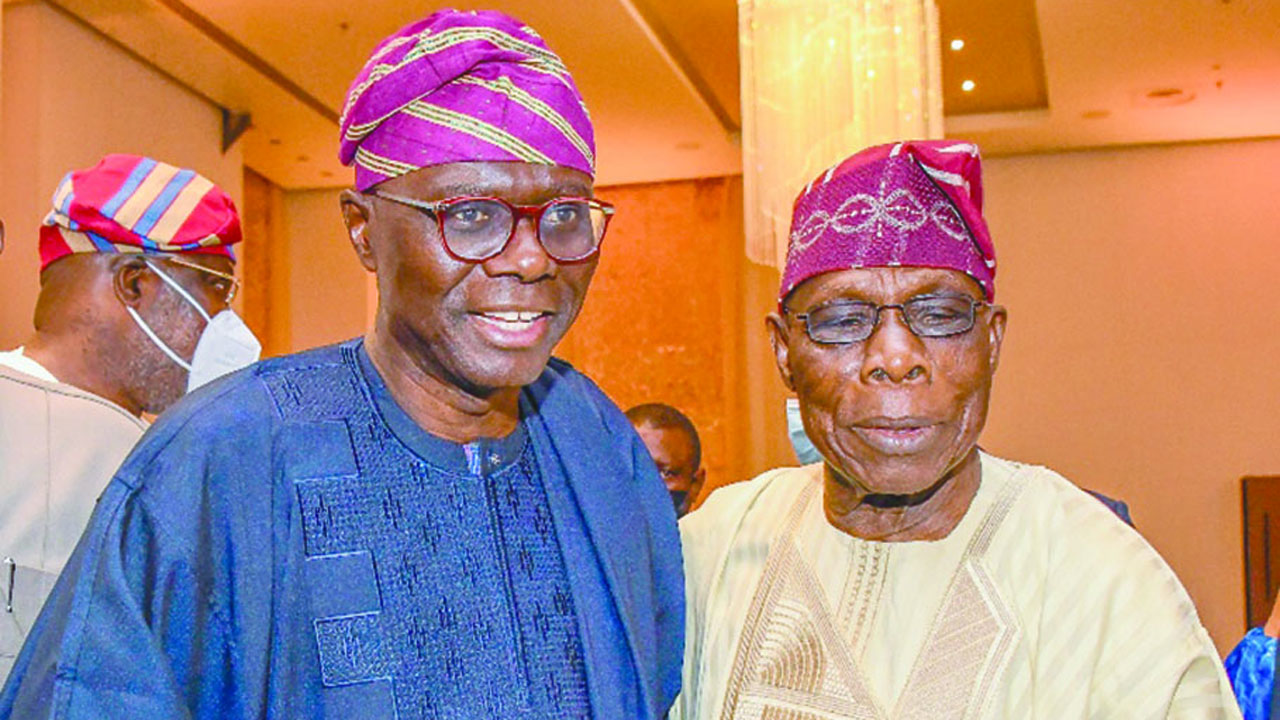

YOU CAN ALSO READ: Obasanjo, Sanwo-Olu Celebrate Flutterwave’s 10 Years of Transforming African Enterprise

Concluding his address, Governor Cardoso stressed that while Nigeria has made remarkable progress, the journey is far from over. Vigilant coordination between fiscal and monetary authorities, coupled with strategic sequencing of reforms, will be crucial to fully unlocking the nation’s potential. His speech at the Presidential Villa framed Nigeria’s economic revival not as a temporary recovery, but as a deliberate, visionary path toward resilience, global competitiveness, and enduring prosperity.