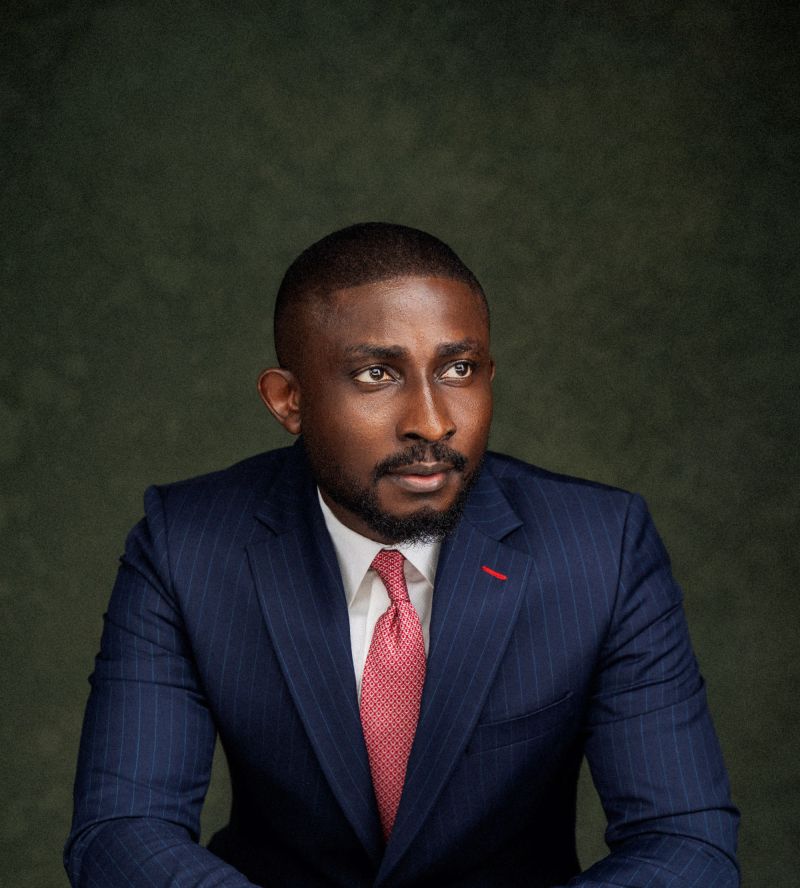

Seyi Ebenezer, Payaza Africa CEO is rewriting the narrative in the African Fintech Industry. The visionary CEO is bringing Africa’s Fintech future to the present, after Payaza raised and repaid ₦14.9 billion via commercial paper in just six months. With Fintech giants like Opay, Palmpay, and Fairmoney controlling a large part of the Fintech in Africa, Seyi Ebenezer Payaza’s is taking bold steps to rejig African Fintech innovation.

An advocate for more investment in localised approach to finance, especially when it comes to credit rating agencies, Seyi is a leading voice in Africa Fintech Revolution.

YOU CAN ALSO READ: Dangote Submits Plans for Proposed Atlantic Seaport in Ogun

Established in 2022, Payaza Fintech platform was built to ease collections and disbursements of funds for small and medium-sized businesses (SMEs).

While giving an insight into credit rating agencies, he stated:

“Africa has one of the lowest default rates globally. It’s interesting to note that Western Europe has a default rate of about 9.1%, so it’s very important for us to write our stories, and we do this by creating our own credit rating agencies.”

With most African Fintech startups implementing audits after some years, Seyi ensured Deloitte Payaza’s audit was from Day 1 and had ₦14.9bn commercial paper issuance fully repaid within six months. This showed a major disruption in the Fintech sector. Furthermore, Payaza’s entry into the Fintech industry indicated why structure, discipline, capital markets, and a strategic plan can work for African Tech Industry Leaders.

In a recent interview, the Payaza Africa Limited boss revealed why every company needs a structure. He stressed that, “while managing many businesses in my banking days, I discovered that the companies with structure were able to stand the test of time despite their issues, while the companies without structure, which were solely dependent on the decisions of a few people, had a lot of issues.”

Additionally, he made it known that technology is vital in sustaining the Fintech industry.

YOU CAN ALSO READ: ‘Three Questions Every CEO Must Ask to Build Enduring Legacy’ – Debbie Larry-Izamoje Charges Business Leaders

He explained:

“In technology today, we talk about speed, artificial intelligence, and innovation. But when it comes to the world of finance, where you handle people’s hard-earned money, then we talk about trust.”

Seyi is one of the most educated Fintech CEOs in Nigeria, with many trainings and experience to his name. Before assuming the Payaza Africa CEO role in January, 2021, he had worked with KPMG, Access Bank, and Keystone Bank.