Wema Bank, partly owned by Nigerian gambling magnate Chief Kessington Adebutu, has taken a decisive step in its recapitalization drive, raising $103.1 million through a rights issue that surpassed expectations. The move not only bolsters the lender’s balance sheet in line with the Central Bank of Nigeria’s (CBN) new capital requirements but also reinforces Adebutu’s growing influence in Nigeria’s banking industry.

The rights issue, which closed at N157 billion ($103.1 million), lifted Wema’s qualifying capital above N210 billion ($137.6 million), comfortably clearing the CBN’s N200 billion ($131 million) threshold. This success marks the first phase of the bank’s recapitalization strategy and signals investor confidence in both Wema’s digital-first model and the strong support of its major shareholders.

YOU CAN ALSO READ: Dreams, Robots and Legacy: The Success Story of Silas Adekunle

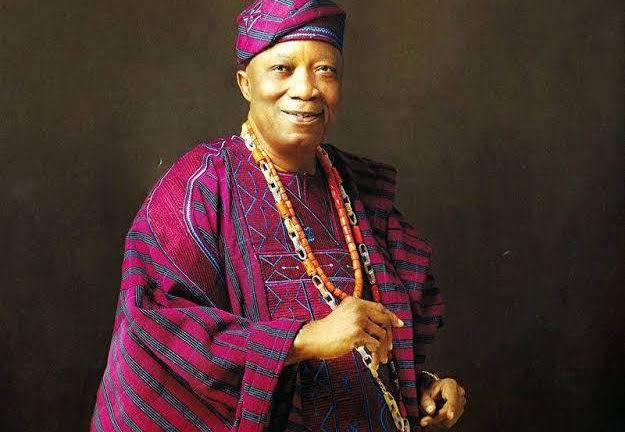

At the heart of that shareholder base is Adebutu. Best known for building his fortune in Nigeria’s gaming industry as founder of Premier Lotto, Adebutu has parlayed decades of business acumen into banking, establishing himself as one of Wema’s anchor investors through his vehicle, Neemtree Limited, which controls 28.26 percent of the bank. His daughter, Abolanle Matel-Okoh, also owns 4.54 percent, further cementing the family’s stake in the financial institution.

For Wema, the capital boost is more than compliance. Managing Director and CEO Moruf Oseni described it as the foundation for sustainable growth. “Having met the recapitalization target, our focus is now on using the stronger capital base to expand lending, invest in digital innovation, and improve customer service,” he said.

The financials reflect momentum. In the first half of 2025, Wema Bank reported a net profit of N87.5 billion ($57.3 million), more than tripling the N26.6 billion ($17.4 million) earned a year earlier. Its shares have surged 158 percent this year, adding millions to Adebutu’s portfolio and underscoring the value of his banking bet.

YOU CAN ALSO READ: Big Names, Bold Ideas: MSME Finance CEO Forum 2025 Targets $1 Trillion Economy

Wema’s transformation has been anchored on ALAT, its flagship digital banking platform, which has positioned the bank as a pioneer in Nigeria’s fintech-driven financial services landscape. With recapitalization achieved and profitability on the rise, the lender is now eyeing growth beyond Nigeria, a move that could further extend Adebutu’s influence in the formal financial sector.

At 89, Adebutu, widely celebrated as the “Odoole of Yorubaland,” is more than a businessman. He is a philanthropist and elder statesman whose fortune has touched communities across Nigeria. Yet his stake in Wema represents more than an investment. It is a legacy move, one that ensures his name and fortune remain deeply embedded in shaping the next chapter of Nigerian banking.