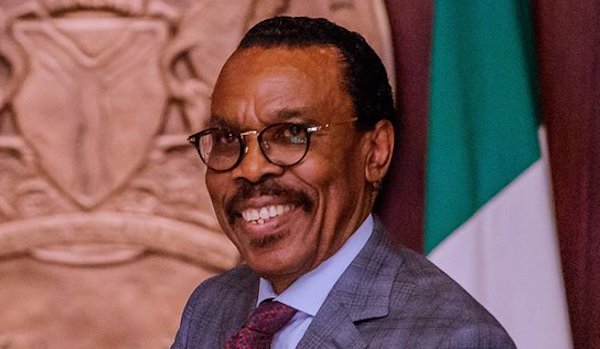

Chief Executive Officer, Financial Derivatives Company, Bismarck Rewane has said Nigeria’s economic fortunes beyond 2025 will depend less on forecasts and more on the quality of judgment applied by policymakers, investors, and institutions.

Speaking on Nigeria’s economic outlook for 2026 and 2027, Rewane stressed that the country must shift attention from short-term analysis to medium-term decision-making. “We are not analysing 2025. Our focus is firmly on 2026 and 2027,” he said. “Forecasts do not matter as much as judgment. When five people are given the same data, they will arrive at five different conclusions. What determines outcomes is not the model, but how decisions are made.”

He explained that reform in Nigeria is often misunderstood, noting that it goes far beyond policy pronouncements. “Reform is not limited to policy announcements. It includes institutional reform, policy execution, and market response. All three must align for reform to deliver real impact,” Rewane said.

YOU CAN ALSO READ: Africa’s Future Depends on Accuracy, Future Mindedness and Responsibility, Otabil Says

Nigeria’s stock market capitalisation currently stands at about ₦90 to ₦91 trillion, representing roughly 20 percent of GDP. “Our projection is that market capitalisation could rise to about ₦262 trillion by 2026 and ₦393 trillion by 2027,” he said, noting that this would represent a significant leap to nearly 80 percent of GDP by 2026. He identified new listings, stronger corporate earnings, and efficiency gains as the key drivers of this growth. A major catalyst, he noted, would be the anticipated listing of the Dangote Refinery. “At an estimated valuation of $30 to $32 billion, the Dangote Refinery alone could add over ₦100 trillion to market capitalisation,” Rewane said. He added that the eventual listing of NNPC would further deepen the market.

While acknowledging aspirations for Nigeria’s GDP to reach $1 trillion by 2030, Rewane was cautious. “Nigeria’s rebased GDP is about $250 billion. Reaching $1 trillion under current conditions is unlikely,” he said. However, he emphasised that capital markets remain critical for mobilising savings, raising capital, and measuring corporate performance.

Rewane noted that interest rates cannot be viewed in isolation from inflation and money supply dynamics. He explained that recent monetary policy decisions reflect anticipated inflation rather than historical data. “Economic behaviour is driven more by expectations of future prices than by what happened last month,” he said. Comparing Nigeria with Ghana, he pointed out structural differences between the two economies.

“Ghana is driven largely by gold, and gold prices have a strong outlook. Nigeria is driven by oil, where price expectations are less favourable,” he said. For Nigeria, Rewane projected a gradual decline in interest rates, though not as sharply as Ghana’s. Inflation, he said, is projected at 12.7 percent in 2026 and 15.3 percent in 2027 before moderating. He identified money supply growth, fuel prices, exchange rate stability, and food security as the main inflation drivers. On the foreign exchange market, Rewane projected relative stability. “We expect the exchange rate to stabilise around ₦1,450 to ₦1,500 in 2026, supported by Central Bank interventions and external buffers, even if oil prices soften,” he said.

Rewane put Nigeria’s gross external reserves at about $45 billion but cautioned against viewing the figure in isolation. “Reserves must be assessed alongside debt levels. Recent increases largely reflect eurobond issuances rather than pure reserve accumulation,” he explained. He described diaspora remittances as a vital pillar of the economy but warned that artificial intelligence-driven disruptions in advanced economies could affect remittance flows. “This may encourage greater domestic economic participation over time,” he said. According to Rewane, long-term growth will depend on total factor productivity, capital stock expansion, and investor confidence. “Investors have no nationality or sentiment. They want returns, stability, and efficiency,” he said.

Rewane said Nigeria’s economy remains constrained by weak net exports and the dominance of government spending. “Improving exchange rate efficiency can significantly boost net exports and overall performance,” he noted, adding that investment remains critical for productivity growth. He identified creative and digital industries, manufacturing, real estate, telecommunications, fintech, and agriculture as key growth drivers. Telecommunications and fintech alone, he said, could generate revenues exceeding ₦41 trillion by 2026.

On the financial services sector, Rewane observed that banking is consolidating and fragmenting at the same time, a sign of structural stress. “Rent-based banking models are fading. The future is efficiency-driven, with intense competition from fintech,” he said. He added that pension assets could rise from ₦26 trillion to about ₦30 trillion by 2026, supported by employment growth and better tax compliance.

YOU CAN ALSO READ: Why Productivity, Not Participation, Is Nigeria’s Real Agricultural Problem

Rewane outlined several risks that could derail projections, including oil prices falling below $60 per barrel, insecurity in food-producing regions, election-related spending pressures, global commodity price shocks, and rising debt service costs. “Borrowing itself is not the problem,” he said. “Debt sustainability depends on how borrowed funds are deployed and managed.”

Looking ahead to 2026, Rewane said Nigeria’s trajectory will be shaped by election dynamics, major capital market listings, declining debt service costs, fiscal adjustments, tax reform implementation, subsidy removal, and continued structural reforms. “Artificial intelligence, digital commerce, and social platforms will increasingly shape productivity and employment,” he said. “Growth is likely to improve moderately, but inflation will remain a persistent challenge.”

In Rewane’s view, Nigeria’s success beyond 2025 will ultimately hinge on the quality of decisions taken today. “The future will not be determined by forecasts,” he said, “but by judgment.”