As Nigeria moves deeper into 2026, Lagos’ luxury real estate market is drawing renewed interest from high-net-worth individuals and members of the diaspora seeking safe and rewarding investments. But what does “luxury” really mean in today’s Lagos, and how has it evolved over the past decade? Is the market still expanding, or has it entered a more selective and discerning phase?

To unpack these questions, the conversation featured the Head of Corporate Communications at Eko Atlantic City, Joanna Fabikun, who shared insights from her global training and on-the-ground experience in Lagos.

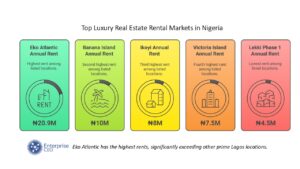

Recent market data highlights the rising cost of luxury rentals in Lagos. A one-bedroom apartment at Eko Atlantic now commands rents of about ₦20.9 million annually, compared with approximately ₦10 million in Banana Island, ₦8 million in Ikoyi, ₦7.5 million in Victoria Island, and ₦4.5 million in Lekki Phase 1. According to industry estimates, Nigeria’s luxury real estate market is valued at over ₦3.2 trillion, or about $7.5 billion, underscoring the scale of capital flowing into the sector.

YOU CAN ALSO READ: Sterling Asset’s Patrick Edimedia Breaks Down 2025 Market Wins and Lessons

Fabikun described the luxury real estate market as resilient, noting that Nigeria’s significant housing deficit means demand continues to outstrip supply. While the sector is firmly in a growth phase, she explained that it is also maturing. Buyers, she said, are becoming far more particular about what qualifies as true luxury, moving beyond buzzwords and glossy marketing to demand real value.

Attention has also expanded beyond residential developments to Grade A office spaces. Fabik observed strong demand on Lagos Island, particularly around Eko Atlantic, while interest is also growing in emerging mainland locations such as Yaba and Ikeja. According to her, savvy investors are increasingly looking beyond already saturated areas to identify the next growth corridors.

December remains a peak period for real estate activity, driven by increased travel and short-let demand. While the festive season delivers impressive short-term returns, Fabik emphasized that many investors are still focused on long-term capital appreciation, with investment choices shaped by individual risk appetite and objectives.

Reflecting on trends from 2025 into 2026, she noted a clear shift in buyer priorities. Investors and homeowners are placing greater emphasis on livability, functionality, and day-to-day comfort rather than just aesthetics. International-standard amenities, professional property management, steady power and water supply, and overall convenience have become critical decision factors.

Comparing today’s market with 2016, Fabik pointed out that luxury previously meant large family homes in gated estates within Ikoyi and Victoria Island. Today, the market has evolved to include ultra-prime waterfront developments in locations such as Banana Island and Eko Atlantic, often with multi-billion-naira price tags.

Addressing concerns about vacant luxury properties and broader economic pressures, including rising poverty levels, Fabik explained that empty units are often a sign of market maturation rather than weak demand. Buyers are increasingly informed and selective, prioritizing developers with proven track records, well-maintained amenities, and properties designed to stand the test of time.

On whether Nigerians are fully experiencing global standards of luxury, Fabik acknowledged lingering challenges such as poor access roads and flooding in some areas. However, she expressed optimism that rising buyer expectations will drive improvements in infrastructure, utilities, and property management from 2026 onwards.

She described today’s luxury buyer base as diverse, ranging from corporate tenants who often lease multiple units, to high-net-worth individuals focused on long-term growth, younger millennials and Gen Z buyers prioritizing lifestyle, technology, and sustainability, as well as diaspora investors leveraging foreign currency strength, particularly in the short-let segment.

Fabikun also highlighted emerging models such as real estate tokenization, joint ventures, and pooled investments as creative ways for lower-income earners to gain exposure to property ownership. She stressed that luxury and affordable housing are interconnected, noting that increased supply at the high end often creates a ripple effect across the broader market.

Investor motivations, she explained, vary widely. Some prioritize capital appreciation, others focus on rental income, while owner-occupiers seek lifestyle benefits such as quality education, healthcare access, and overall convenience.

YOU CAN ALSO READ: Owning the Narrative: Steve Babaeko and Africa’s Creative Revolution

Looking ahead to 2026, Fabik identified luxury real estate as a preferred asset class for developers seeking to hedge against macroeconomic uncertainty. She also pointed to growing interest in alternative real estate assets, including data centres, which signal strong investor confidence and offer diversification opportunities.

While diaspora demand remains important, she emphasized that local demand continues to anchor the market. In her view, sustainable growth depends primarily on meeting the needs and expectations of domestic buyers.

As the year unfolds, Fabikun expects heightened scrutiny of developers, with buyers demanding superior finishes, durable construction, professional management, and greater integration of technology and sustainability. Smart features such as solar power solutions, biometric security systems, and green building certifications are becoming increasingly common, particularly in premium residential and office developments.

She expressed optimism about the sector’s contribution to Nigeria’s GDP, noting that rising standards and evolving buyer expectations position the real estate market for sustained growth in the years ahead.