Nigeria’s equities market ended 2025 on a record-breaking note, with the NGX All Share Index posting a year-to-date return of over 51% and total market capitalization surging past ₦99 trillion. For investors and market watchers, the stellar performance raised questions: what fueled this rally, and what lies ahead in 2026?

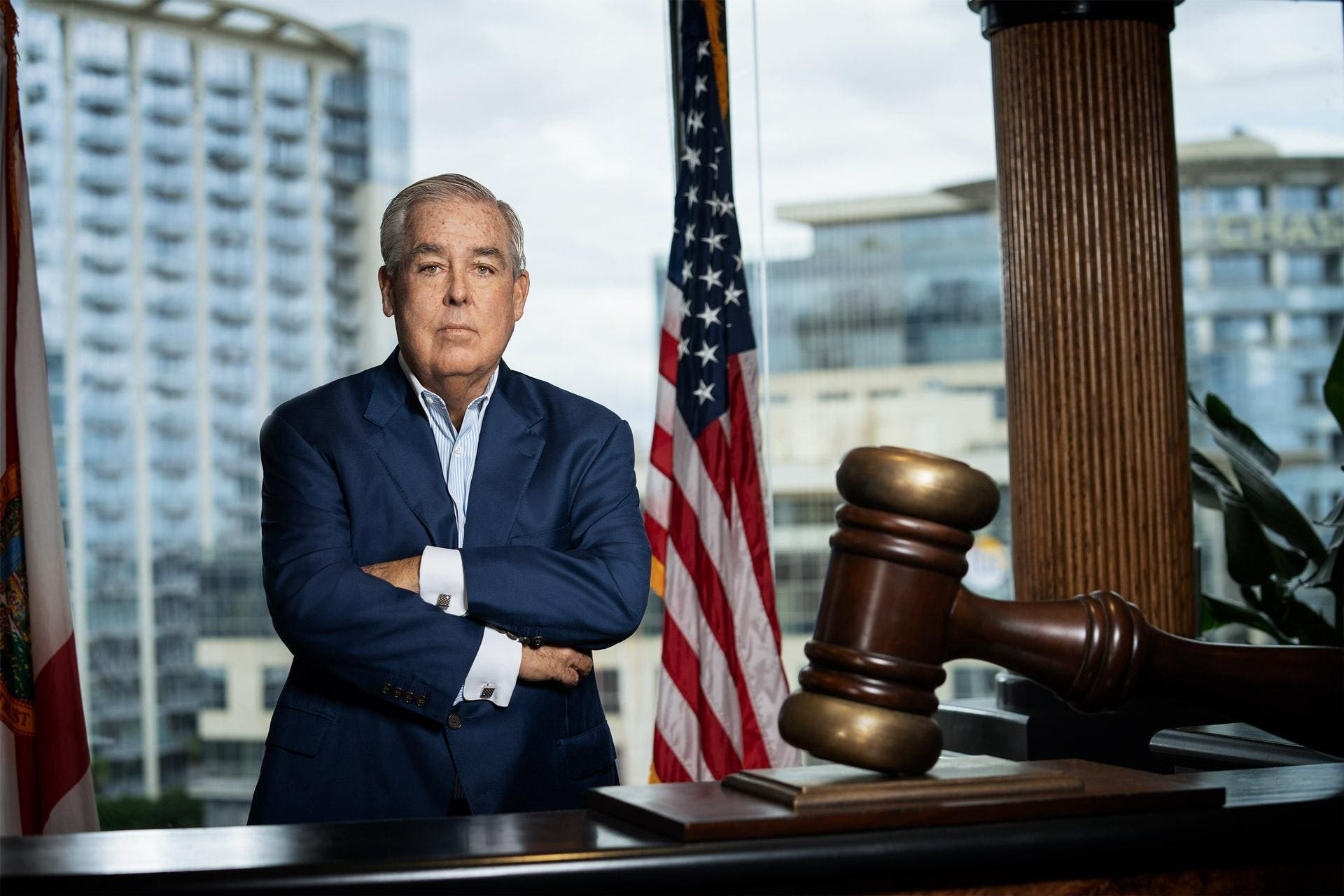

Head of Research at Sterling Asset Management and Trustees Limited, Patrick Edimedia, PhD, Nigeria stock market performance shared his insights on the forces behind Nigeria’s historic stock market run and the lessons investors can draw from last year’s performance.

Edimedia describes 2025 as “one of the strongest years for Nigerian equities in decades,” pointing out that the last comparable growth occurred in 2020 and before that in 2003. He attributes the surge to improved investor confidence, macroeconomic stability, and a shift from fixed income investments to equities.

YOU CAN ALSO READ: ‘No Need to Panic Over New Tax Laws,’ KPMG’s Adewale Ajayi Reassures Nigerians

“Investors always seek returns that outpace inflation,” Edimedia explains. “As fixed income yields declined last year while inflation started easing, equities became an effective hedge against rising prices.”

According to Edimedia, consumer goods led the market with a remarkable 129% year-to-date return, defying expectations given persistent double-digit inflation. The insurance and banking sectors also performed strongly, buoyed by ongoing recapitalization efforts and regulatory reforms. Industrial goods recorded nearly 59% growth, supported by infrastructure spending and import substitution policies.

“Much of the market capitalization growth—around 70%—was driven by share price appreciation in large-cap stocks, reflecting strong investor confidence,” Edimedia notes.

While most sectors surged, oil and gas underperformed due to declining production, high operational costs, and falling global oil prices. Edimedia emphasizes that firms that improve efficiency and address security challenges are better positioned to perform in this environment.

Edimedia highlighted the growing but still smaller role of foreign investors. Portfolio inflows increased from roughly ₦0.8 trillion to ₦2 trillion in 2025, while domestic investors accounted for about ₦8 trillion, underscoring the importance of local participation in driving the market.

Edimedia advises investors to focus on fundamentals and company efficiency. “Thorough fundamental and technical analysis is essential to identify the right sectors and firms for investment,” he says. He stresses that careful evaluation of firm-specific factors is crucial, particularly in sectors with structural or infrastructural challenges.

YOU CAN ALSO READ: Wale Tinubu Hails Otedola, Elumelu for Deals That Define 2026

While 2025 was historic, Edimedia cautions that markets remain volatile. “Volatility is part of the market, but I expect it to trend upward,” he says. Continued rate cuts, easing inflation, and sustained macroeconomic stability should keep equities attractive relative to fixed income. Investors are encouraged to identify undervalued stocks and monitor efficiency within companies to maximize returns.

Patrick Edimedia’s analysis offers a comprehensive view of the Nigerian equities market, highlighting both opportunities and challenges. As investors position themselves for 2026, his insights provide a roadmap for navigating a dynamic and historically significant market.