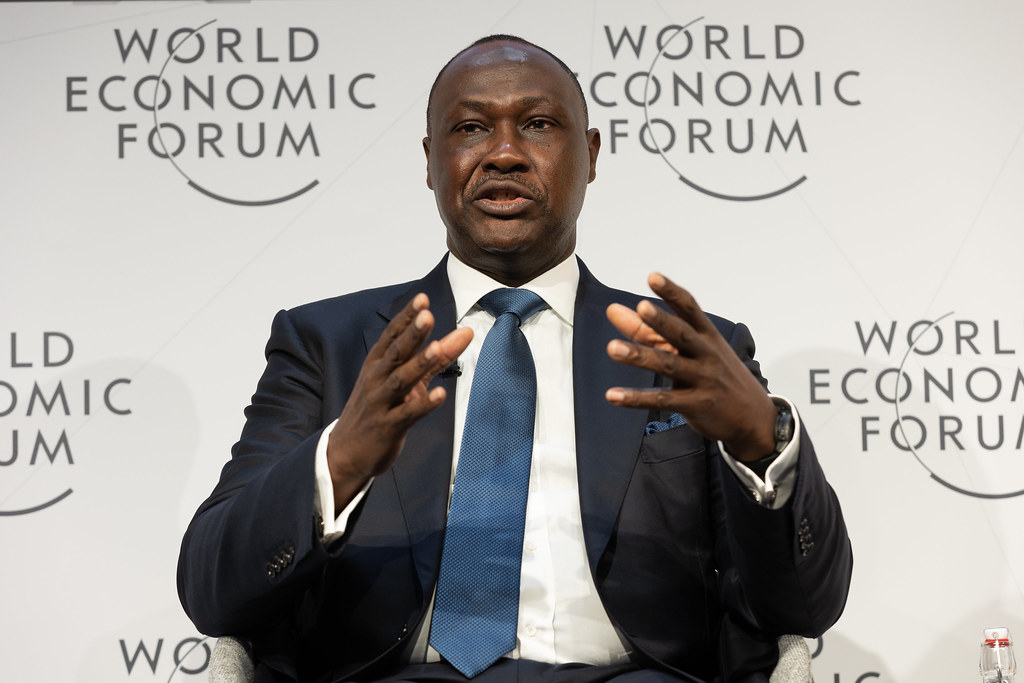

President and CEO of the Africa Finance Corporation (AFC), Samaila Zubairu has long been a champion of transforming Africa’s potential into tangible, bankable projects. Zubairy was speaking at the ongoing World Economic Forum at Davos with business leaders and industry stakeholders.

He outlined a strategic framework for leveraging domestic capital as the foundation for sustainable economic growth across the continent.

“Every investor wants to see domestic capital committed first. Without it, international investment rarely follows,” Zubairu said. “As Africans, we must take ownership of our development, prove our business cases, and show that we are invested ourselves. Only then will global investors be confident to scale initiatives alongside us.”

YOU CAN ALSO READ: Davos 2026: Trump Presents U.S. as the New Global Growth Engine

Drawing on nearly three decades of experience in investment and infrastructure financing, Zubairu emphasized that success begins at home. AFC’s model centers on identifying high-potential opportunities, aligning local capital behind these initiatives, and then mobilizing skilled international funding to expand and scale. This approach has proven effective across multiple sectors, from energy and mining to transport and telecommunications, and Zubairu is advocating for its adoption continent-wide.

A key pillar of this strategy is the mobilization of pension funds. In Nigeria, for example, AFC has implemented a structured asset allocation system, dedicating portions to infrastructure equity, bonds, and venture capital. To mitigate risk and build confidence among institutional investors, AFC developed investment-grade guarantee programs such as InfraCredit, a collaborative effort with the Nigeria Sovereign Investment Authority (NSIA) and UK development finance partners. These programs are now being scaled to East and Southern Africa, creating a framework for continental adoption.

“Pension funds must feel confident because they are responsible for protecting the savings of millions,” Zubairu noted. “By providing risk-mitigation tools and structured financial instruments, we make it easier for domestic institutions to invest and drive growth from within the continent.”

Zubairu also underscored that African-led investment does not exclude international participation. He cited a recent gold mining project in Sierra Leone, which was largely led by African institutions with participation from sovereign wealth funds and international partners. “International investors are still interested, but the pathway is smoother when domestic investors have proven their commitment,” he explained. “By putting your skin in the game first, you create an attractive platform for others to join.”

Beyond investment mechanics, Zubairu stressed the broader economic implications. Mobilizing domestic capital not only finances critical infrastructure but also strengthens local markets, builds institutional capacity, and fosters a culture of accountability and entrepreneurship. According to him, this approach is essential for Africa to compete globally and achieve sustainable, inclusive growth.

YOU CAN ALSO READ: Nigeria Pivots Away From Debt, Courts Investment Amid Global Trade Tensions

For CEOs, entrepreneurs, and policymakers, Zubairu’s insights provide a clear roadmap: develop strong business cases, secure domestic backing, and create enabling structures for investment. With AFC leading by example, Africa has a blueprint for turning potential into impact, demonstrating that strategic deployment of domestic capital can unlock transformative growth across the continent.

“Domestic investment is the spark,” Zubairu concluded. “International capital is the fuel that allows Africa to scale. When both are aligned, the opportunities are limitless.”