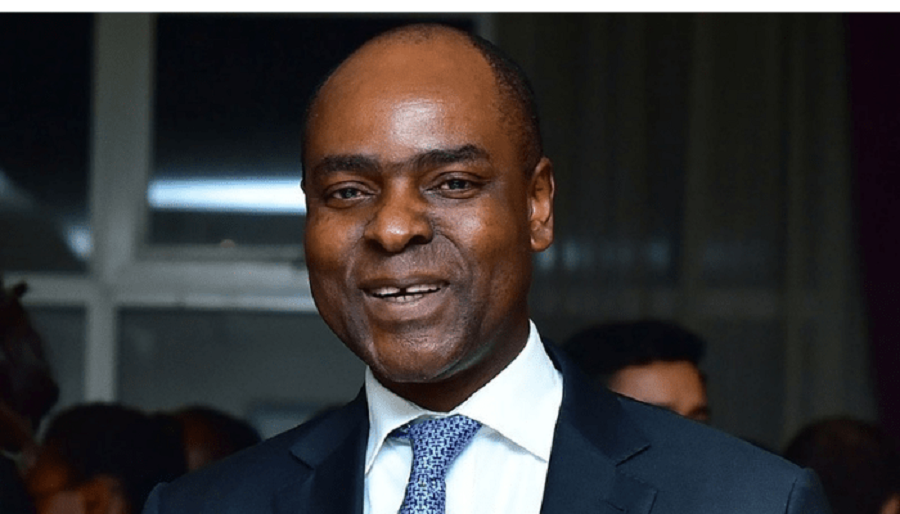

At the Lagos Business of Film Summit, Bolaji Balogun did not speak like a financier exploring a new sector. He spoke like an investor explaining an inevitability.

As Chief Executive Officer of Chapel Hill Denham, Balogun has spent decades allocating capital across Nigeria’s most complex industries. Yet his message to filmmakers, creatives, policymakers, and investors was strikingly clear: Nigeria’s creative economy is no longer a side conversation about culture. It is a central conversation about growth, influence, and the future structure of the Nigerian economy.

Rather than opening with balance sheets or forecasts, Balogun anchored his argument in experience. His entry into film investment, he explained, came through relationships and trust, a reminder that even in capital markets, belief often precedes numbers. What ultimately validated those early decisions was not applause or awards, but returns.

In Balogun’s framing, repeatable returns are the true language of sustainability. Each successful transaction, he noted, extends the lifespan of an idea and builds the confidence needed for the next investment. Recent deals that have already yielded results only strengthened his conviction that creative ventures, when properly structured, belong firmly within institutional portfolios.

YOU CAN ALSO READ: Wale Tinubu Inspires Africa’s Emerging Leaders

But Balogun’s most powerful argument went beyond profitability. He placed Nigeria’s creative economy inside a sweeping demographic reality that few sectors can ignore. Nigeria is growing, rapidly and inexorably, toward becoming one of the world’s most populous nations. Within a generation, the country is expected to approach half a billion people.

For Balogun, this scale changes everything.

A population of that size, he argued, will not only require food, housing, and financial services. It will demand stories, meaning, entertainment, and identity. Culture will not be optional; it will be infrastructure. And those who control the mechanisms of storytelling will shape how Nigeria understands itself and how the world understands Nigeria.

This is where film and creative content move from soft power to economic strategy. Balogun observed that Nigeria’s struggle to attract sustained foreign investment has often been rooted in perception. Investors hesitate when they cannot relate to a place or its people. Storytelling, he suggested, closes that gap by replacing abstraction with familiarity.

When people see a society’s art, history, humor, and contradictions, they begin to see opportunity rather than risk. In that sense, every successful Nigerian film, series, or creative export quietly lowers the psychological barrier to investment.

Balogun’s long view of the industry also reflected patience earned over decades. His first entertainment investment dates back nearly 30 years, a time when the sector was largely dismissed as informal and unserious. For years, financial returns were slow, and institutional interest was minimal.

Today, that narrative is changing.

Streaming platforms, global distribution, improved production quality, and growing audiences have transformed what was once a fragmented industry into an emerging asset class. Balogun suggested that Nigeria is now approaching an inflection point where creative content can scale in the same way telecoms and fintech once did.

If that happens, the implications are enormous. He projected that the creative economy could, over time, account for up to a quarter of Nigeria’s GDP, translating into hundreds of billions of dollars in value. More importantly, it could become one of the country’s largest employers, absorbing talent across education levels and regions.

However, Balogun was careful to emphasize that scale will not happen by accident. Collaboration, he argued, is non-negotiable. The idea of lone creators building an industry is outdated. Capital, talent, distributors, regulators, and educators must operate as a system rather than silos.

Policy also matters. Rather than waiting for government funding, Balogun advocated for intelligent incentives that encourage private capital to participate. Tax structures, he said, are often more powerful than subsidies in shaping investor behavior.

Data, too, remains a missing link. Passion alone cannot unlock capital. Investors need clear evidence of revenue, audience metrics, and repeatable business models. Until the industry speaks fluently in numbers as well as narratives, large pools of capital will remain cautious.

Infrastructure emerged as perhaps the most urgent requirement. Nigeria’s creative ambitions cannot be sustained without studios, post-production facilities, archives, and distribution networks built to global standards. Such infrastructure, Balogun noted, typically attracts long-term institutional investors like pension funds and family offices, not individuals.

YOU CAN ALSO READ: First Bank Holdings Clears ₦748 Billion in Legacy Loans, Eyes Strong 2026 Growth

Talent development presents another structural challenge. With much of Nigeria’s creative workforce self-taught, Balogun called for intentional training systems and professional talent management structures capable of supporting global careers and exports.

He also highlighted the importance of digitization and preservation. Nigeria’s creative history, much of it stored in aging archives, represents untapped value. Without proper digitization and monetization, decades of content risk being lost to time rather than leveraged for growth.

In the end, Balogun’s message was neither romantic nor cynical. It was pragmatic.

The creative economy, he suggested, will succeed not because it is beautiful, but because it is necessary. It will matter not only because it entertains, but because it employs, earns, preserves identity, and reshapes perception.

Nigeria, he implied, will tell its story one way or another. The real question is whether it will build the structures that allow those stories to create lasting economic value.